In this article, we will explain how to trade Binance Options. You can check out the articles on the meaning of options and the difference between call and put options. A review is written at the bottom of this posting, so please refer to it.

What are Binance Options?

Options are derivative trading products that allow you to achieve large profits with a small amount of money. Binance has launched options in the crypto market (such as Bitcoin) based on the same method used in stock or commodity exchanges (securities firms, etc.). That is, through options trading, you can generate a higher rate of return than futures with less investment capital.

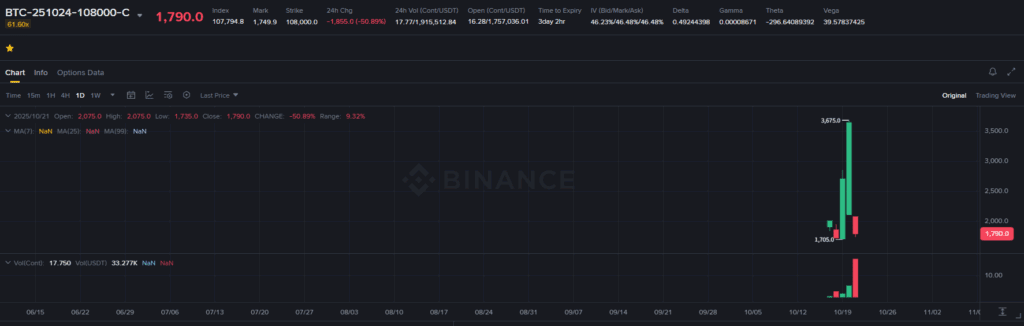

Take this example: a Bitcoin option contract expiring on 2025-10-24.

It roughly rose by double from the low point and then halved again.

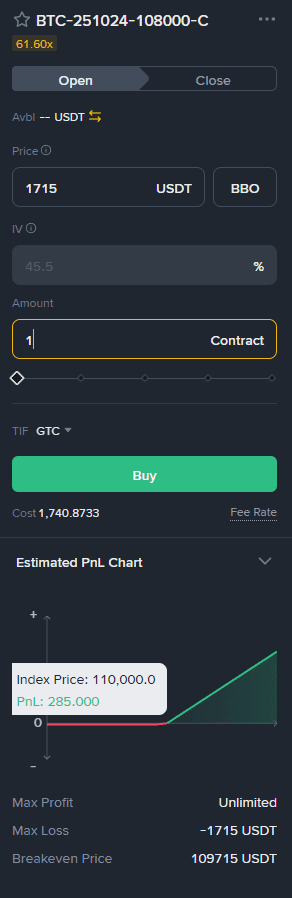

Let's consider trading one of these. The premium for buying a Call Option is 1,715 USD.

You are buying 1 contract for 1,715 USD. The maximum loss is limited to the premium amount, 1,715 USD, but the maximum profit depends on how high Bitcoin's price goes.

Currently, the Bitcoin contract price is 109,715, and it is kindly indicated that a profit of 285 USD would occur if Bitcoin rises to 110,000 USD.

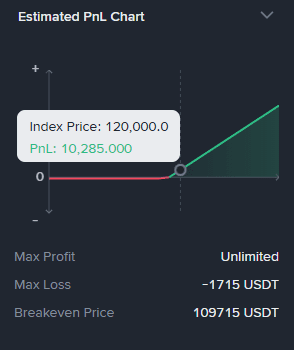

What if Bitcoin goes up to 120,000 USD?

A profit of 10,285 USD will be made.

In the case of futures, losses occur as much as the price falls, and profits occur as much as the price rises. However, with options (unless you are selling an option), the loss is predetermined. If you buy even just 1 contract of an option (either a Call or a Put) at a certain strategic point, you can make a large profit.

Binance Futures Trading VS Options Trading Difference

| Category | Binance Futures | Binance Options |

|---|---|---|

| Product Nature | Futures contracts involve an obligationfor the trader to buy or sell the underlying asset. | Crypto options give the trader the rightto buy or sell the underlying asset, but no obligation. |

| Risk | High risk. Open positions can be liquidated. | The option buyer's risk is limited to the premium amount paid. |

| Entry Cost | Cost-effective. Only margin is required, with no additional upfront cost other than trading fees and funding rates. | Option contracts require the payment of a premium (the cost of the option). |

| Time Value | Futures contracts are rarely affected by time value decay. | The time value of options decreases as the expiration date approaches. |

Here are explanations for parts that might be confusing:

First, with futures trading, the loss increases the more the price moves against the position you've taken. It is certain that you will incur a loss the more it moves in the opposite direction.

However, options trading gives you the right to buy (or sell) at that price. So, if the price moves against you and you cannot profit, you can simply say, 'I won't buy that,' and only lose the initial premium amount paid.

In other words, the downside (maximum loss) is fixed.

The disadvantage is that this premium cost is fixed. While futures trading is possible with a very small amount (around 5 USD), options trading is structured per 1 contract, requiring payment of 1,715 USD per contract in the example above.

In expiring futures, there should normally be time value. However, futures traded on crypto exchanges generally do not have an expiration date, so time value does not exist. Conversely, options must have a set expiration date for the trade to be completed. Therefore, time value is added when the option is issued, making the premium price more expensive, but the premium price gets cheaper closer to expiration.

his is why people sometimes buy Zero-Day Options, which expire on the same day. If a major event occurs on the expiration date, a huge profit occurs; if nothing happens, the premium is lost.

Binance Option Trading Fees

Some people say there are no trading fees for Binance Options, but there are.

- Transaction Fee Rate : 0.03%

- Exericse Fee Rate : 0.015%

- Liquidation Fee Rate : 0.19%

Please check the details below for more information.

Binance Option Trading Fee Summary (Translation)

Option trading fees consist of two components: the Transaction Fee and the Exercise Fee. 와 행사 수수료(Exercise Fee) 의 두 가지 구성 요소로 이루어져 있습니다.

1. Transaction Fee

A transaction fee is charged when opening or closing a position.

The fee for each trade is calculated based on the Spot Index Price of the underlying asset at the time the order is executed, and is capped at 10% of the option's value. 으로 합니다.

- Transaction Fee Rate: 0.03%

- Calculation Formula:

Transaction Fee = Minimum [ (Transaction Fee Rate * Index Price * Contract Size), (Option Trading Price * 10%) ] * Option Trading Quantity

Example

(ETHUSDT Call Option 3 contracts):

- ETHUSDT Call Option

- 기초자산: ETH

- Price : 2,000USDT

- 3 contracts

- 만기일: 2022-04-30

- Premium : 1,000 USDT

If the Spot Index Price is 2,000 USDT and the Premium is 1,000 USDT.

이 주문은 ETHUSDT 현물 지수가 2,000 USDT일 때 체결되었습니다.

so,

Transaction Fee = Minimum (0.03% * 2,000, 10% * 1,000) * 3 = 1.8 USDT 1.8 USDT

2. Exercise Fee

An exercise fee is charged every time an option is exercised. 행사 수수료가 부과됩니다.

The fee for each transaction is calculated based on the Settlement Price at the time the order is executed, and is capped at 10% of the option's value.으로 합니다.

- Exercise Fee Rate: 0.015% 0.015%

- Calculation Formula:

Exercise Fee = Minimum [ (Exercise Fee Rate * Settlement Price * Contract Size), (Option Value * 10%) ] * Position Size

Example

(ETHUSDT Call Option 3 contracts):

- ETHUSDT Call Option

- 기초자산: ETH

- price : 2,000USDT

- 3 contracts

- 만기일: 2022-04-30

- Settlement Price : 2,200USDT

- Premium : 2,000USDT

so,

Exercise Fee = Minimum [0.015% * 2,200, 10% * (2,200 − 2,000)] * 3 = 0.99 USDT 0.99 USDT

3. Liquidation Fee

A liquidation fee is charged if a user's position is liquidated. 될 경우 청산 수수료가 부과됩니다.

calculated based on the Spot Index Price of the underlying assetat the time the order is executed, and is capped at 25% of the option's value.으로 합니다.

- Liquidation Fee Rate: 0.19%

- Calculation Formula:

Liquidation Fee = Minimum [ (Liquidation Fee Rate * Index Price * Contract Size* abs(Position Size)), (Option Premium for that liquidation * 25%) ]

Example

(ETHUSDT Call Option 3 contracts):

- ETHUSDT Call Option

- 기초자산: ETH

- Price : 2,000USDT

- 3 contracts

- 만기일: 2022-04-30

- Settlement Price : 2,200USDT

- Liquidation premium : 100USDT

If the Index Price is 2,000 USDT and the Liquidation Premium is 100 USDT. Liquidation Fee = Minimum (0.19% * 2,000 * 1 * |3|, 100 * 25%) = 11.4 USDT

How to Trade Binance Options – Binance Options Trading Method

Before proceeding with Binance Options, if you wish to trade, check the maximum fee discount method below for a free maker fee and a 60% taker fee discount.

💰 Binance Taker Fee Free, 60% Market Fee Discount MethodAfter signing up, completing identity verification, and depositing funds, go to the Options window as shown below.

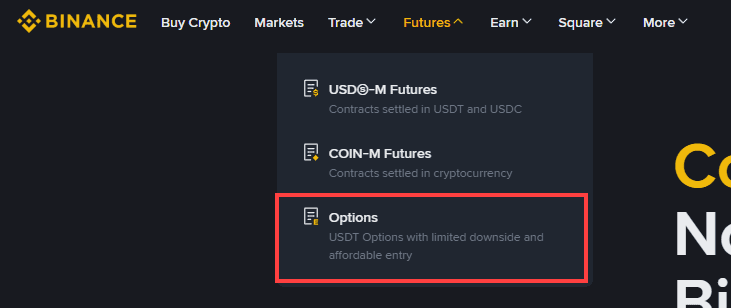

Navigate to Binance Options Window

Go to the Options tab under Binance Futures.

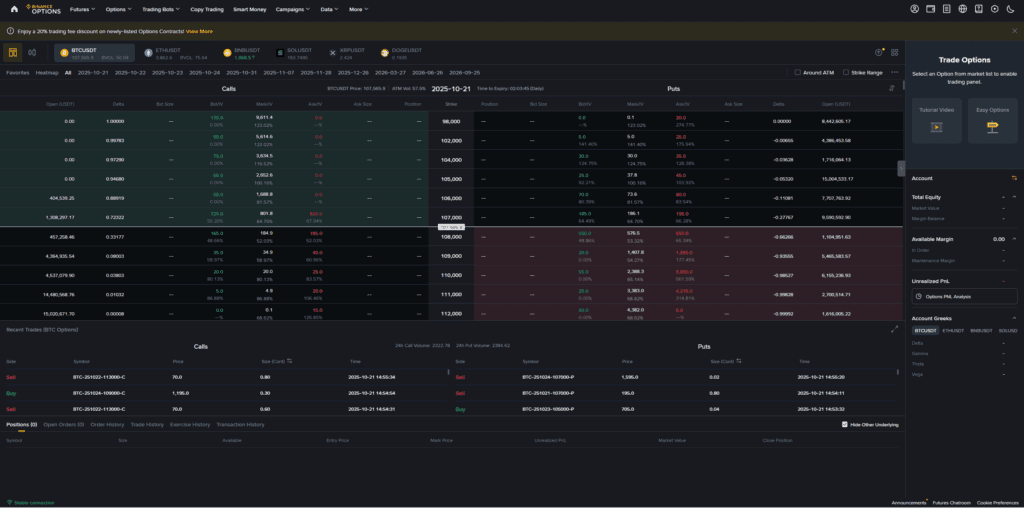

This brings up a screen that is quite complex. Options are inherently complicated with terms like "In-the-money" and "Out-of-the-money." Since understanding options can be difficult on Binance, they have prepared a tutorial and an Easy Options mode on the right side.

Binance Official Options Tutorial Video

Clicking the tutorial will show you a video created directly by Binance about options. However, it is in English, so you should keep that in mind.

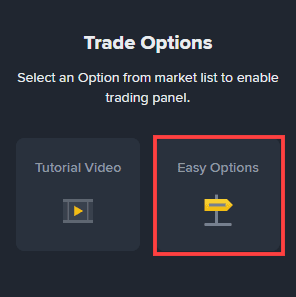

Options Easy Mode

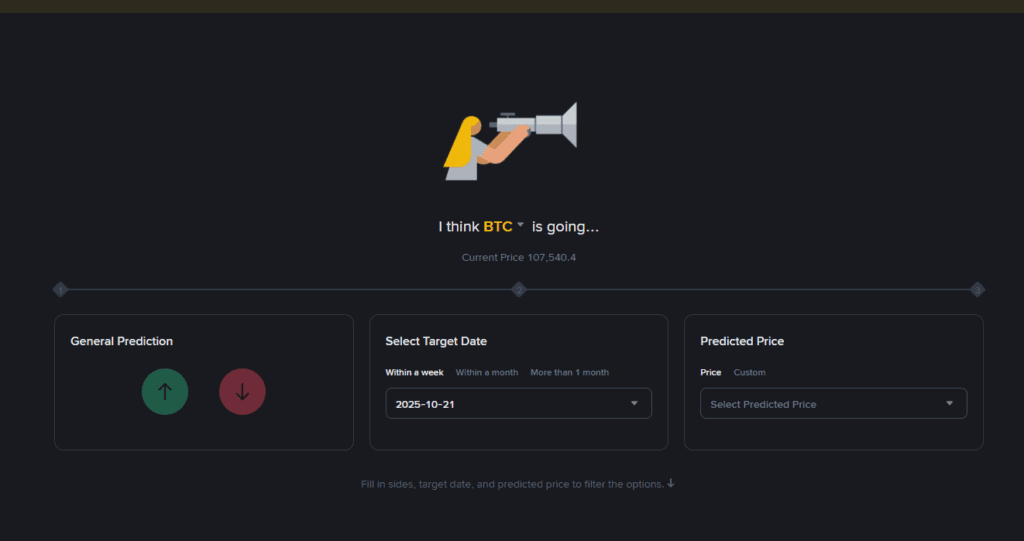

If you want to try trading using the Easy Mode, click Easy Options on the right.

This brings up a very simple screen, unlike the complex window seen before.

I Think XXX is going… (Select Asset):

This is where you choose the product you want to buy an option for.

Currently, only Bitcoin, Ethereum, Solana, BNB, Doge, and Ripple are available.

General Prediction (Set Direction)

Decide whether the price will go up or down.

Select Target Date (Set Expiration)

Set the expiration date. You can view weekly, monthly, or longer than a month.

Predicted Price (Set Price)

Set the price directly or select a predefined price.

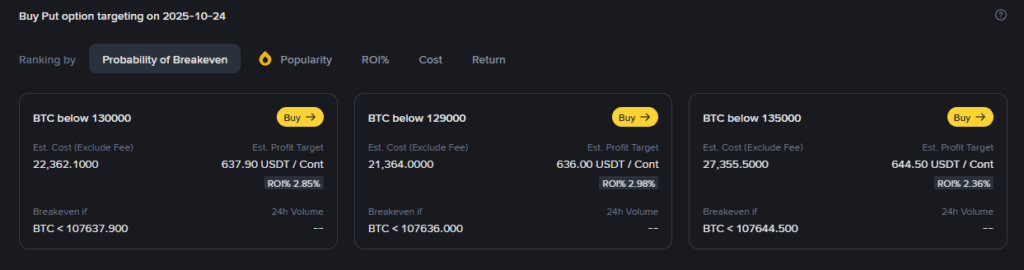

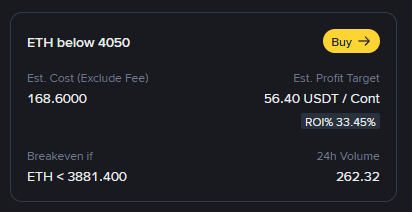

After setting everything, a screen like the one below appears.

Help

Use Options as an investment tool when you have a price forecast for a coin.

The Easy Options feature automatically calculates the potential profit or lossfor each option simply by entering your predicted price.

You can purchase options based on your risk preferenceand, if your prediction is correct, exercise the optionto realize a profit.

Est. Cost (Estimated Cost, excluding fees)

The purchase cost of an option contract is calculated based on the current Mark Price. 를 기준으로 산정됩니다.

Est. Profit Target (Estimated Profit Target)

If the coin price reaches your predicted target price on the Settlement date (expiration date),

the profit is calculated using the following formula:

- Call Option:

Predicted Price – Strike Price – Mark Price - Put Option:

Strike Price – Predicted Price – Mark Price

Breakeven Condition

If the price reaches the level below on the expiration date, it will be at the Breakeven point, where there is neither profit nor loss.

The calculation formula is as follows:

To Breakeven %

= (Breakeven Price – Index Price) / Index Price

Call Breakeven Price

= Strike Price + Mark Price / Contract Size

Put Breakeven Price

= Strike Price – Mark Price / Contract Size

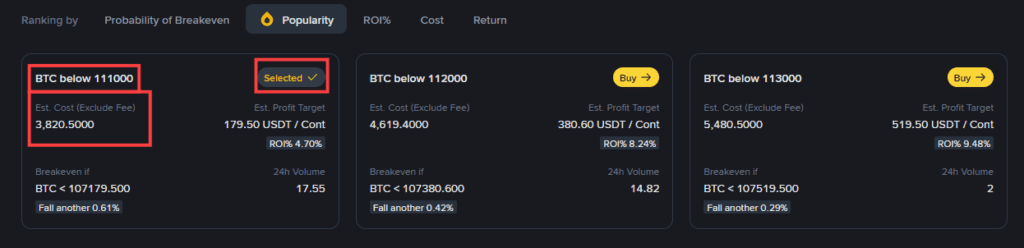

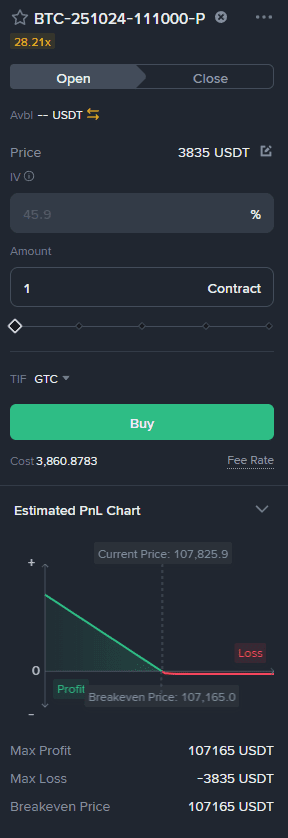

Popularity often means the premium is the cheapest. The author is currently looking at a Put Option (Short) purchase, and since Bitcoin has dropped by 2-3% today, the Put Option premium is more expensive now.

The BTC below value at the top is the price you're trading at, and the Est. Cost below that is the premium value.

Clicking Buy-> brings up the screen below.

If you enter '1' next to Contract, the PnL chart appears below.

Currently, this contract costs 3,845 USD, almost double the Call Option premium.

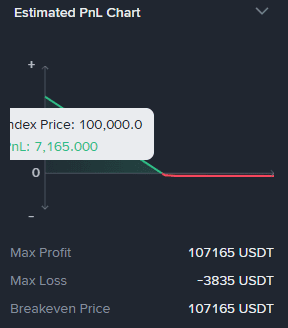

If the price drops to 100,000 USD, you will earn 7,165 USD, nearly double the premium. If it drops further, additional profit can be made.

Clicking Buy allows you to trade immediately.

The position is automatically liquidated upon expiration, but you can also sell it before then.

Note that because Bitcoin's price is around 100,000 USD, the price per 1 contract is high. However, if you trade options with relatively smaller coins like Ethereum, the price per 1 contract is significantly reduced.

The contract terms above show a price of about 168 USD per contract, which is about 1/20th of the Bitcoin Put Option 1 contract. So, if you want to trade with less money, trade Solana, BNB, Ripple, or Doge Options, or trade Bitcoin and Ethereum contracts in decimal units rather than 1 contract.

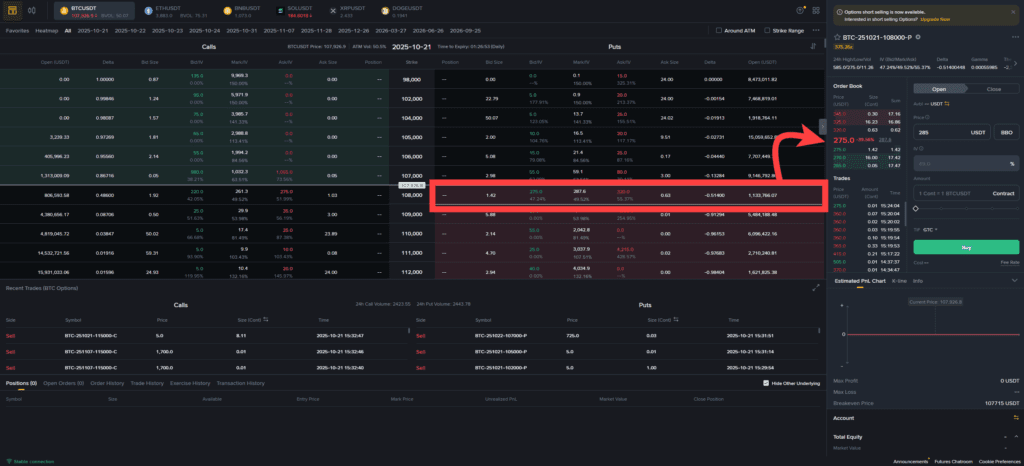

eneral Options Trading Mode

In the General Options Trading Mode, you can select the contract you want and purchase it immediately.

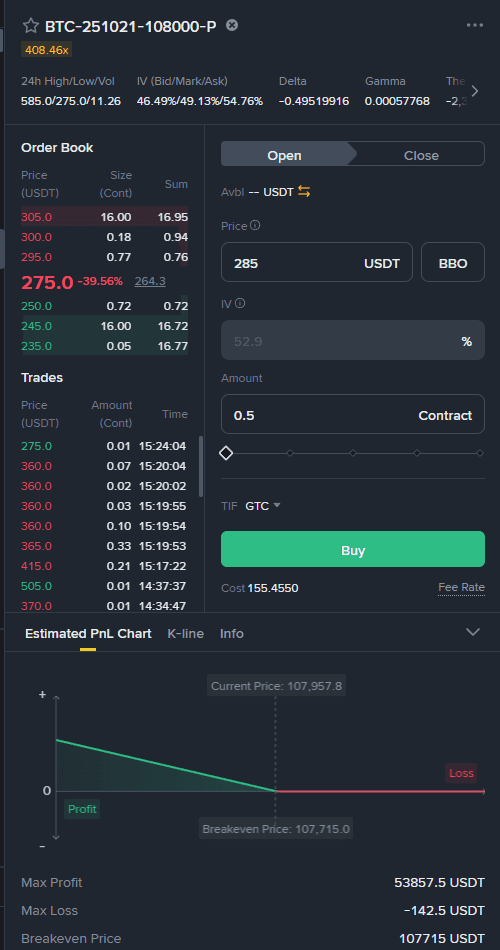

As shown in the picture above, if you want to buy a Bitcoin 108,000 USD Put Option, click on it and trade on the right-hand screen.

Note: Contracts can also be traded in decimals, such as 0.5.

Where to Check Bitcoin Option Expiration Dates

There is a separate place to check the Bitcoin Option expiration dates. There is also a place to check the Bitcoin Futures expiration dates. In fact, most people trade Bitcoin futures indefinitely, but this is for those who occasionally trade with a specific duration.

Please check the link below.

Bitcoin Futures Trading Method

Bitcoin futures trading is not possible on domestic exchanges due to the Special Financial Information Act (특금법). Therefore, you must use overseas exchanges such as Binance, Bybit, Gate.io, or OKX.

Please refer to the article below.

Binance Futures Trading Review

Many people think futures trading is only dangerous. Why not check the Binance Futures trading review and judge for yourself? Personally, it is easier to read than the review that came up in the "How to Trade Binance Options" section.

Binance Usage Guide

We have gathered all the previously compiled exchange usage guides and Q&A into a roadmap for easy viewing. Please bookmark and use it.

[Check Crypto Exchange Usage Guide]