Many people who invest in virtual currency may have felt that spot trading alone was insufficient. Binance Futures Trading is a method that allows you to aim for large profits with small capital by utilizing leverage. In this article, I will explain the latest 2025 version of how to trade Binance Futures step-by-step so that even beginners can understand.

What is Binance Futures Trading?

Binance Futures Trading is a type of transaction where you promise to buy or sell a coin at a set price at a specific point in the future, rather than purchasing it at the current price. It allows for larger-scale trades than your actual held funds by utilizing leverage, and you can profit in both bull and bear markets.

Unlike typical spot trading, futures trading allows you to trade in two directions: a Long position (buy) and a Short position (sell). If you expect the coin price to rise, you take a Long position; if you expect it to fall, you take a Short position.

Meaning of Futures Trading

Futures trading is called "Futures" in English. As the English meaning suggests, futures trading is characterized by predicting the price at a specific future time, where you gain a profit if the price at the expiry date is higher than your expected market price, and incur a loss if it is lower.

Many people engage in futures trading because leverage is possible. Leverage is the function that allows you to buy and sell several times more than the amount of money you actually have.

For example, if you have 1,000 USD and 20x leverage is possible, you can purchase 20,000 USD worth. Therefore, it has the advantage that even people with small amounts of money can significantly increase their profits.

Binance Futures Risk Level

While profits can be significantly increased, futures trading also carries considerable risk.

For example, let's say a person with 100 USDT buys the entire Ethereum coin using 20x leverage. Then, they can purchase 2,000 USDT worth of Ethereum.

If Ethereum rises by 5%, the actual profit I get is 5% times 20 = 100%. Conversely, if Ethereum drops by 5%, my actual loss is 100%, meaning I lose all the money I possess.

Preparations to Start Binance Futures Trading

Account Sign-up and Verification

To start Binance Futures trading, you first need a Binance account. If you already have an account for spot trading, you can start futures trading without a separate sign-up process.

If you haven't signed up for Binance yet, you can sign up at the link below. Upon signing up, you can receive a $20\%$ discount on trading fees with the maximum discount rate.

🤑 [Join Binance with 20% Discount Link]Futures trading is only possible after Identity Verification (KYC) is complete, which generally requires submitting an ID and proof of address documents. The verification process usually takes about 5 minutes, or up to a day at most.

If you are unsure of the detailed sign-up method, please refer to how to sign up for Binance.I will tell you how to get limit orders for free and a $60\%$ discount on market orders in that article.

How to Deposit Funds

In korea, Since Binance does not support direct deposit of Korean Won (KRW), you must use the method of purchasing USDT or Bitcoin through a domestic exchange and then sending it to Binance. You can buy coins on a domestic exchange like Upbit or Bithumb and then transfer them to your Binance wallet address.

The deposited funds are stored in the spot wallet, and for futures trading, the funds must be transferred to the futures wallet. This process is handled instantly within Binance.

If you don't know how to deposit from Upbit or Bithumb to Binance, please refer to the articles below.

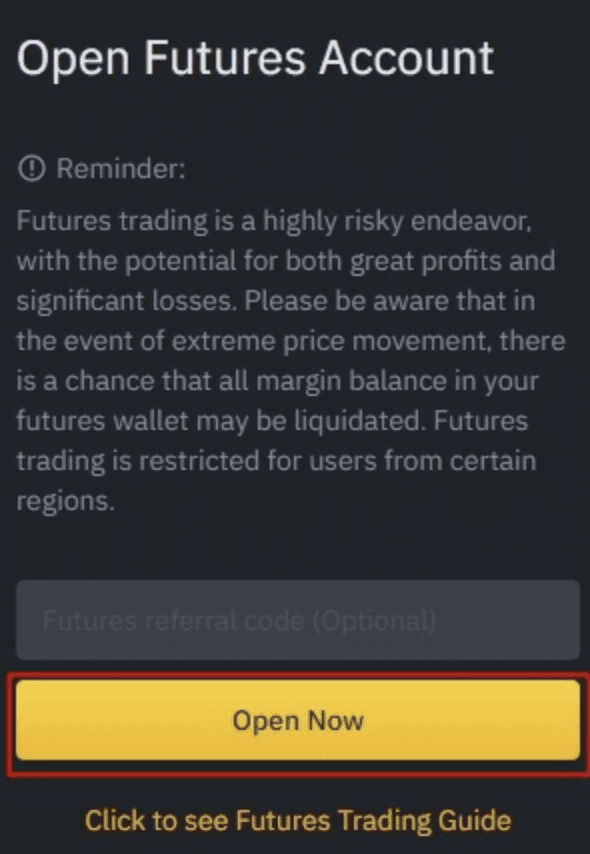

Creating a Futures Account

When you go to 'Futures' on Binance, you will see a screen like the one above. Immediately click 'Open Now'.

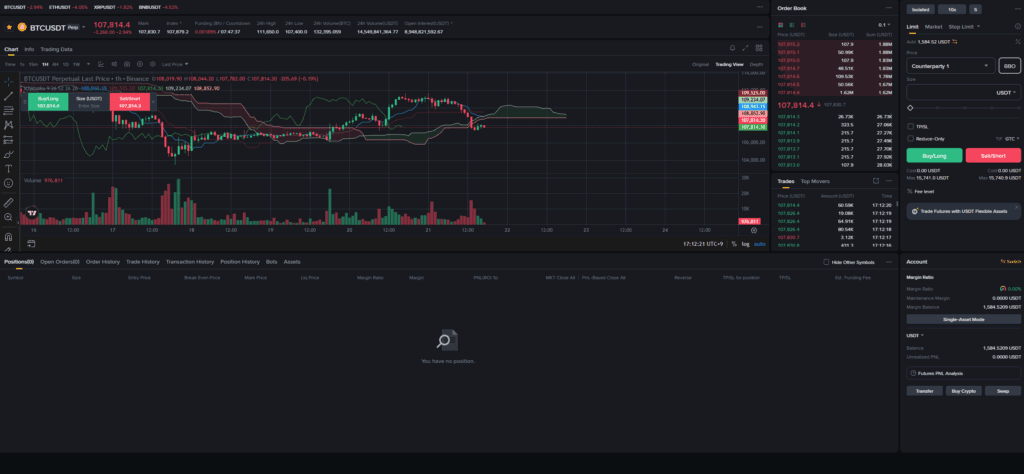

Binance Futures Trading Interface

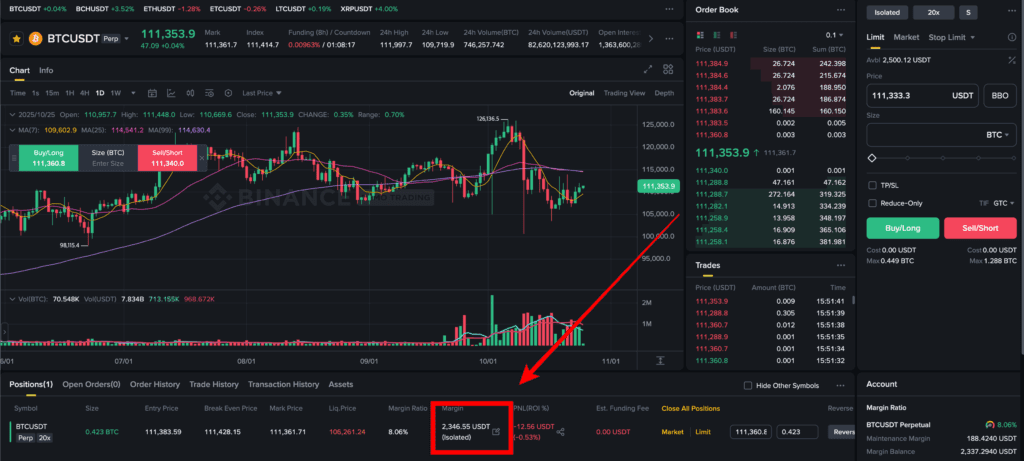

The Binance Futures trading screen is similar to spot trading but has a few additional features. You can select the coin pair to trade at the top of the screen, and the chart and order book are displayed in the center.

On the right, there is the order entry window, where you can set leverage, select the margin mode, order type, and more. At the bottom, your currently held positions and order history are displayed.

I will explain the interface in more detail in the trading method section.

How to Trade Binance Futures

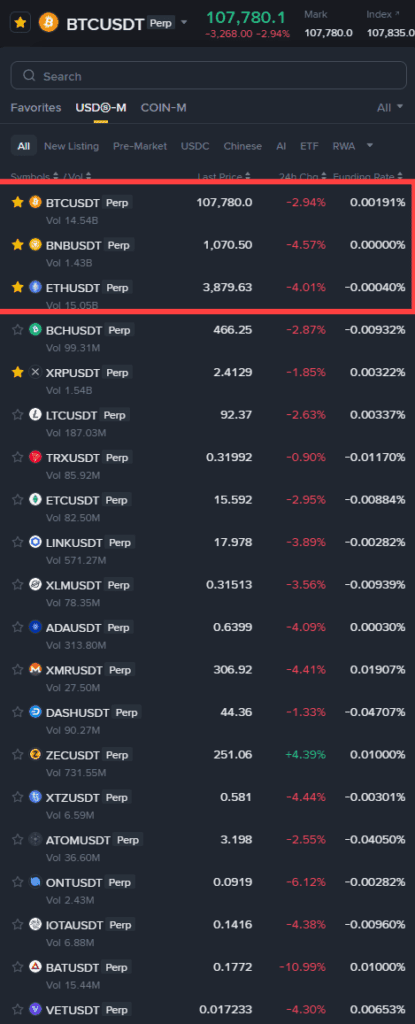

Select Trading Pair

Select the coin you want to trade on Binance. Beginners should start with major coins with high liquidity and relatively low volatility, such as Bitcoin (BTCUSDT) or Ethereum (ETHUSDT).

Set Leverage

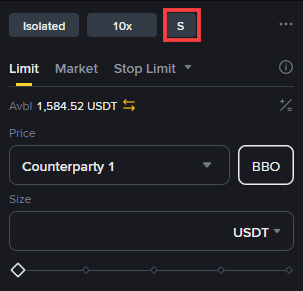

Select the desired multiplier in the leverage settings at the top of the screen. The default is 10x. You can change it to your desired multiplier.

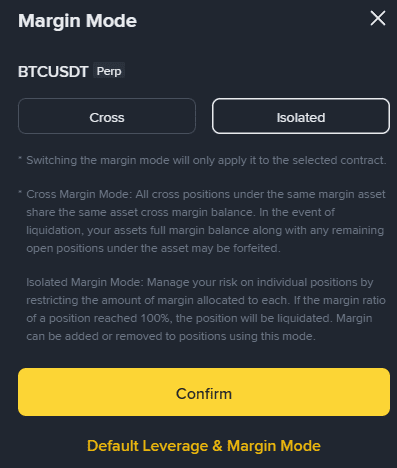

Select Margin Mode

If you are a beginner, select Isolated Margin mode and set the margin amount to be used for that specific trade. It is safe to start with about 5-10% of your total funds.

Cross

It refers to using all the funds in your futures wallet as margin.

Regardless of the amount used for the position, you can protect the position even with a negative return of over $100\%$. It is generally used when the position size itself is very large or for high leverage.

Isolated

This mode automatically liquidates the position if the amount of the position you took reaches -100%. The money in your wallet other than the position itself does not become margin.

Select Asset Mode

I recommend beginners to leave it as is, but those who want to know more can refer to the article below.

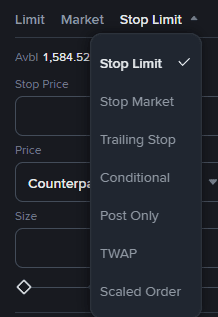

Select Order Type

You can choose between Market order and Limit order. A Market order is executed instantly but may incur slippage, while a Limit order allows you to trade at the exact price you want but may not be executed.

There are differences in how orders are placed for each trading method.

The most commonly used are Limit and Market.

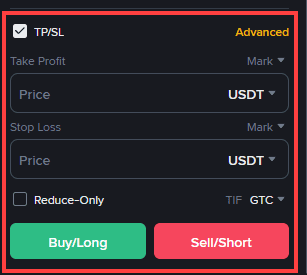

Select Long/Short Position

If you expect the coin price to rise, select a Long position; if you expect it to fall, select a Short position.

Set Stop Loss and Take Profit

It is important to pre-set a Stop Loss and Take Profit for risk management. Generally, a Stop Loss of 2-3% relative to the entry price is set.

Execute Order

Once all settings are complete, execute the order. After execution, you can check your profit and loss in real-time on the position management screen.

What is Binance Margin?

Margin, also called collateral, is the guarantee deposit required before engaging in leverageable trades like Binance futures trading or margin trading.

The margin varies depending on the size of the position, and the larger the position, the larger the margin.

Let's take an example. If you use 5x leverage, the profit is multiplied by 5, but the risk also increases by 5 times. If losses become too large, the possibility of liquidation increases.

If the loss becomes too large, the Binance exchange forces liquidation, and the amount they require you to deposit in advance for this forced liquidation is essentially the margin.

Binance Maintenance Margin Rate

How much coin futures margin is required to maintain a position on the Binance exchange?

The maintenance margin rate on the Binance exchange is 0.4% for Level 1 (1 BTC). Therefore, the maintenance margin amount can be calculated using Start Value times 0.4%.

For example, if the Bitcoin price is 50,000 USDT, the required maintenance margin would be 200 USDT.

Then, after how much loss will liquidation proceed?

Binance Futures Liquidation

If you are curious about Binance futures liquidation, please check the article below where the information is summarized.

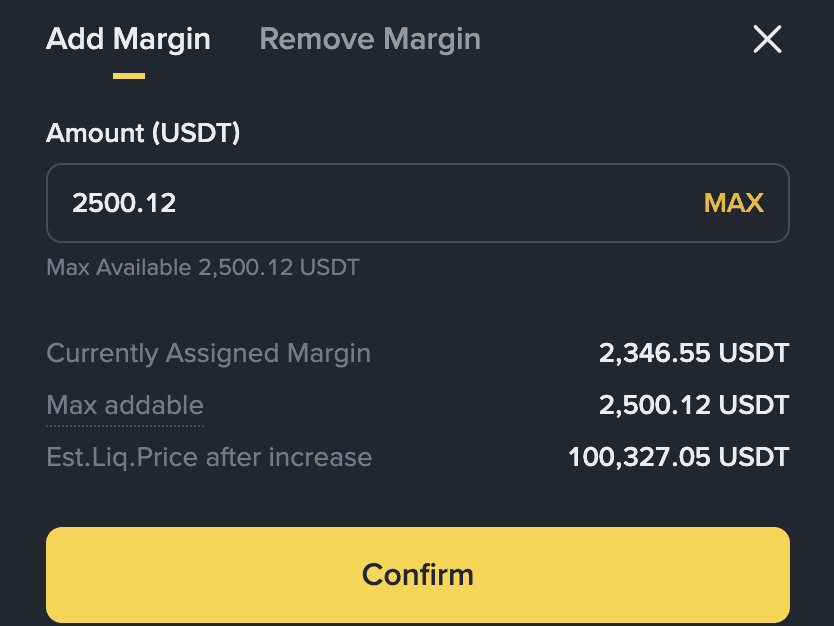

How to Add Margin to Binance Futures

Note that the Add Margin button is only available in Isolated mode. For Cross mode, if you want to add margin, you can simply transfer additional funds to your futures wallet.

1. When you access the Binance futures trading screen, there is a Position window at the bottom. This section represents the currently remaining margin.

2. To add margin, click the button on the right side of the position.

3. Click the [Add Margin] tab, enter the amount of USDT margin to add, and click the confirmation button to complete the margin addition.

If you add 2500 dollars more, you can confirm that the estimated liquidation price (Est.Liq.Price after increase) has been lowered.

Thus, even in margin trading (Isolated mode), you can survive longer by increasing the margin size without adding more funds in the 'averaging down' sense (similar to Cross mode).

Binance Futures Trading Fee Structure

Trading Fees

The basic fees for Binance futures trading are 0.02% for Maker and 0.04% for Taker. The Maker fee is applied when an order is executed as a Limit order, and the Taker fee is applied when executed as a Market order.

If you hold BNB tokens, you can receive fee discounts, and lower fees are applied as your VIP level increases based on your trading volume.

Funding Fees

In futures trading, a funding fee is incurred every 8 hours. This is a fee to adjust the difference between the futures price and the spot price, and you may either receive it or pay it depending on the direction of your position.

The funding fee is usually determined between 0.01% and 0.1%, and it fluctuates depending on market conditions.

There is also a way to generate profit through this funding fee.

Utilizing Advanced Futures Trading Features

Auto-Invest Feature

Binance provides a feature for automatic, regular purchases. This allows the Dollar-Cost Averaging (DCA) strategy to be applied to futures trading.

Trailing Stop Feature

The Trailing Stop is a feature that automatically adjusts the stop-loss price when the price moves in a favorable direction. This allows you to protect profits while not missing out on potential further upside.

Copy Trading Feature

Beginners lacking experience can utilize the feature to copy the trades of successful traders. However, even in this case, risk management must be handled by the individual.

Tax and Reporting Matters

Tax Reporting When Using an Overseas Exchange

Since Binance is an overseas exchange based on Korean standards, profits generated are subject to Comprehensive Income Tax reporting. You must report if your annual profit exceeds 2,500,000 KRW.

It is advisable to accurately record your transaction history and seek assistance from a tax professional if necessary.

Fund Movement Management

The movement of funds between domestic and overseas exchanges may be subject to the Foreign Exchange Transaction Act. It is advisable to check the relevant laws when moving large sums of money.

Frequently Asked Questions (FAQ)

Q: What is the minimum amount for Binance futures trading?

A: Futures trading is usually possible from about 10 USDT on Binance. However, it is recommended to start with a larger amount for risk management.

Q: What is the difference between futures trading and spot trading?

A: Spot trading is the purchase of actual coins, while futures trading is trading a contract based on a future price. In futures trading, leverage can be used, and a short position is also possible.

Q: How much leverage can be used?

A: Binance supports up to 125x leverage, but it is recommended that beginners start with around 2-5x.

Q: What happens if liquidation occurs?

A: If liquidation occurs, you lose all the margin for that position. To avoid liquidation, appropriate leverage settings and stop-loss settings are important.

Q: Is 24-hour trading possible?

A: Yes, the virtual currency market is open 24 hours, so trading is possible at any time. However, volatility often appears significantly during US market hours.

Q: How is tax on futures trading profit calculated?

A: In the case of Korea, using an overseas exchange is classified as other income and is subject to Comprehensive Income Tax reporting. Reporting is required when the annual profit exceeds 2,500,000 KRW.

Binance futures trading can be an effective investment tool if supported by correct knowledge and thorough risk management. However, it also comes with high risks, so please engage in real trading only after sufficient learning and practice.

Binance Usage Guide

We have gathered all the previously compiled exchange usage guides and Q&A into a roadmap for easy viewing. Please bookmark and use it.

[Check Crypto Exchange Usage Guide]